Following American Oversight Court Win, Government Unseals Secretive IRS-ICE Agreement That Could Compromise Sensitive Taxpayer Data of Millions

The agreement largely eschews independent oversight and accountability — leaving personal information at risk of abuse and violations of civil liberties.

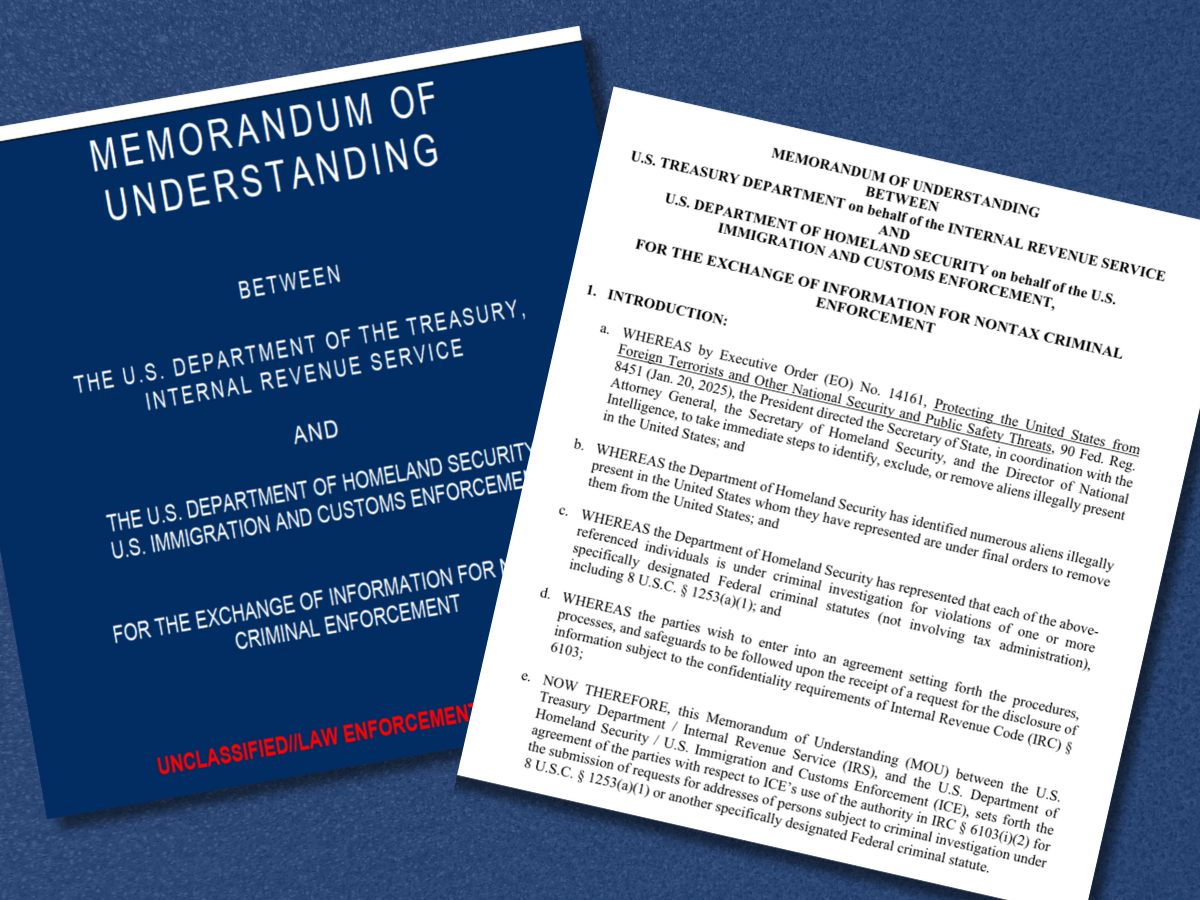

Today, following a successful motion by nonpartisan watchdog American Oversight, a federal court made public previously sealed filings and the government filed publicly for the first time an almost entirely unredacted memorandum of understanding (MOU) between the Internal Revenue Service (IRS) and U.S. Immigration and Customs Enforcement (ICE) — a controversial agreement that could jeopardize the sensitive taxpayer information of millions.

The newly unsealed MOU confirms that ICE — and its contractors — will be entrusted with broad access to sensitive taxpayer-submitted address data to further the agency’s enforcement goals, yet appears to rely entirely on internal compliance and self-reporting concerning when and how the information will be exchanged. The absence of meaningful independent oversight, external auditing, or accountability mechanisms raises serious risks of unchecked misuse and civil liberties violations.

In response, American Oversight released the following statement from Executive Director Chioma Chukwu:

“Government agencies should never be allowed to collude behind closed doors to avoid public scrutiny — especially when their decisions could endanger the sensitive taxpayer data of millions.

“The MOU between the IRS and ICE raises deeply troubling questions about data privacy, civil liberties, and the lack of oversight. It’s no wonder they tried to keep it sealed. It gives the agencies sweeping discretion over personal information, yet it contains no provisions for independent oversight or external accountability for ICE’s entitlement to this data — leaving the potential for unchecked abuse dangerously high.

“These documents confirm what we feared: Not only is the Trump administration using databases containing sensitive personal information in ways that were never intended, but it’s doing so deliberately to advance its partisan agenda.”

The controversy surrounding the IRS’s agreement with ICE reportedly contributed to the resignation of acting IRS Commissioner Melanie Krause, who announced her decision to step down from the post she’s held since 2024 as questions mounted over the controversial arrangement.

Additional Background

Public Citizen filed the underlying case on behalf of plaintiffs Centro de Trabajadores Unidos and Immigrant Solidarity DuPage to prevent the IRS from engaging in the unauthorized disclosure of taxpayer information for immigration enforcement purposes.

On Monday, May 12, in a significant win for government transparency, American Oversight secured a court order requiring the near-complete unsealing of the MOU between the IRS and ICE, as well as related previously sealed legal filings. The ruling comes as the court also denied the plaintiffs’ motion for a preliminary injunction, leaving the challenged data-sharing policy in place for now. That outcome underscores the importance of the MOU’s public scrutiny: Enforcement of this controversial policy could impact countless individuals and communities across the country, and its details must be brought into the light of day.

American Oversight’s motion noted that the government filed a redacted version of the MOU to support its response to the plaintiffs’ motion for a preliminary injunction, which was filed on April 7. During a preliminary injunction hearing on April 16, the government apparently provided an unredacted MOU to the court and the plaintiffs under a protective order arranged in open court. The plaintiffs subsequently filed a supplemental memorandum on April 23, with both redacted and sealed versions.