New Reports Find Billions in CARES Act Funding Went to Companies with Histories of Misconduct

Reports from Good Jobs First and Congress highlight the importance of rigorous oversight of coronavirus relief programs.

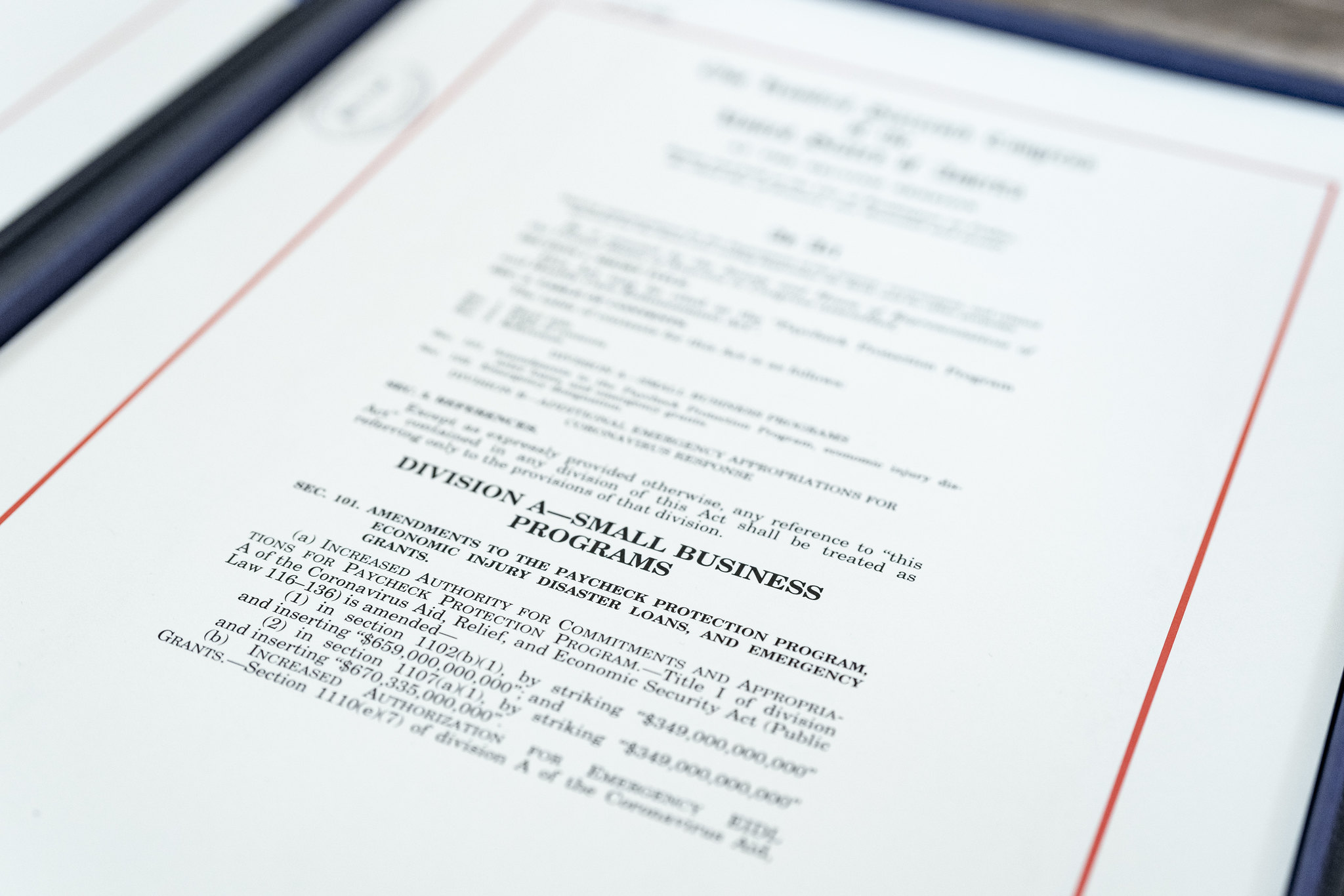

On Tuesday, corporate watchdog group Good Jobs First released a comprehensive report looking at the companies that have received CARES Act funding. The report found that more than 43,000 CARES Act aid recipients — including health-care providers, colleges, and airlines — have engaged in some form of corporate misconduct over the past decade. In total, they have received $57 billion in grants and $91 billion in loans through the CARES Act, which Congress passed in the spring to provide pandemic relief funding.

According to Good Jobs First, $85 billion in federal grants and loans went to more than 6,000 health-care providers that had a record of misconduct. In the past, those hospitals and providers had paid more than $9 billion in penalties, mostly related to accusations of Medicare and Medicaid billing fraud, though six were linked to cases involving criminal allegations.

The report also found that 38,000 small-business beneficiaries had paid past penalties for offenses, with the biggest portion of those penalties having come from wage theft: More than 10,000 of those companies had been cited for violating overtime and minimum wage regulations. But workplace safety, health offenses, and skirting environmental regulations were also major reasons many of these companies had paid penalties. Despite this, these small businesses received $37 billion in loans.

The report also found that scores of colleges and universities that received grants — including for-profit institutions that have been accused of using misleading marketing to attract students and then trap them with mountains of debt — had previously paid millions in penalties. These organizations received around $500 million in grants, but had actually paid nearly double that — $900 million — in penalties over the years.

Finally, the largest individual amounts of aid went to companies in the aviation sector, including major airlines that had previously paid penalties for safety violations, employment discrimination, and price fixing. These companies received $25 billion in grants and loans.

This report, as well as last week’s congressional report on the Paycheck Protection Program, highlight the need for rigorous oversight of coronavirus relief. Although the CARES Act prohibited companies from receiving multiple loans, the House Select Subcommittee on the Coronavirus Crisis found more than 10,000 cases of repeated loans — totaling more than $1 billion. The subcommittee’s investigation also revealed that hundreds of loans went to companies that are either suspended from working with the government or have been previously flagged by the government for performance or integrity issues. This parallels the trends in the Good Jobs First report, which shows that integrity and performance issues extend beyond PPP to other CARES Act aid recipients as well.

Both reports suggest that the administration, particularly the Small Business Administration and Treasury Department, did not carefully vet many of the companies receiving aid. As the congressional report points out, the administration’s rules require that it audit loans of more than $2 million, which only covered 65 of the more than 10,000 loans to companies that collected more than once.

American Oversight has filed a number of Freedom of Information Act requests for more information about PPP and CARES Act relief funds. You can read more at our Covid-19 Oversight Hub, and use our Oversight Tracker to see other investigations into where money has gone.