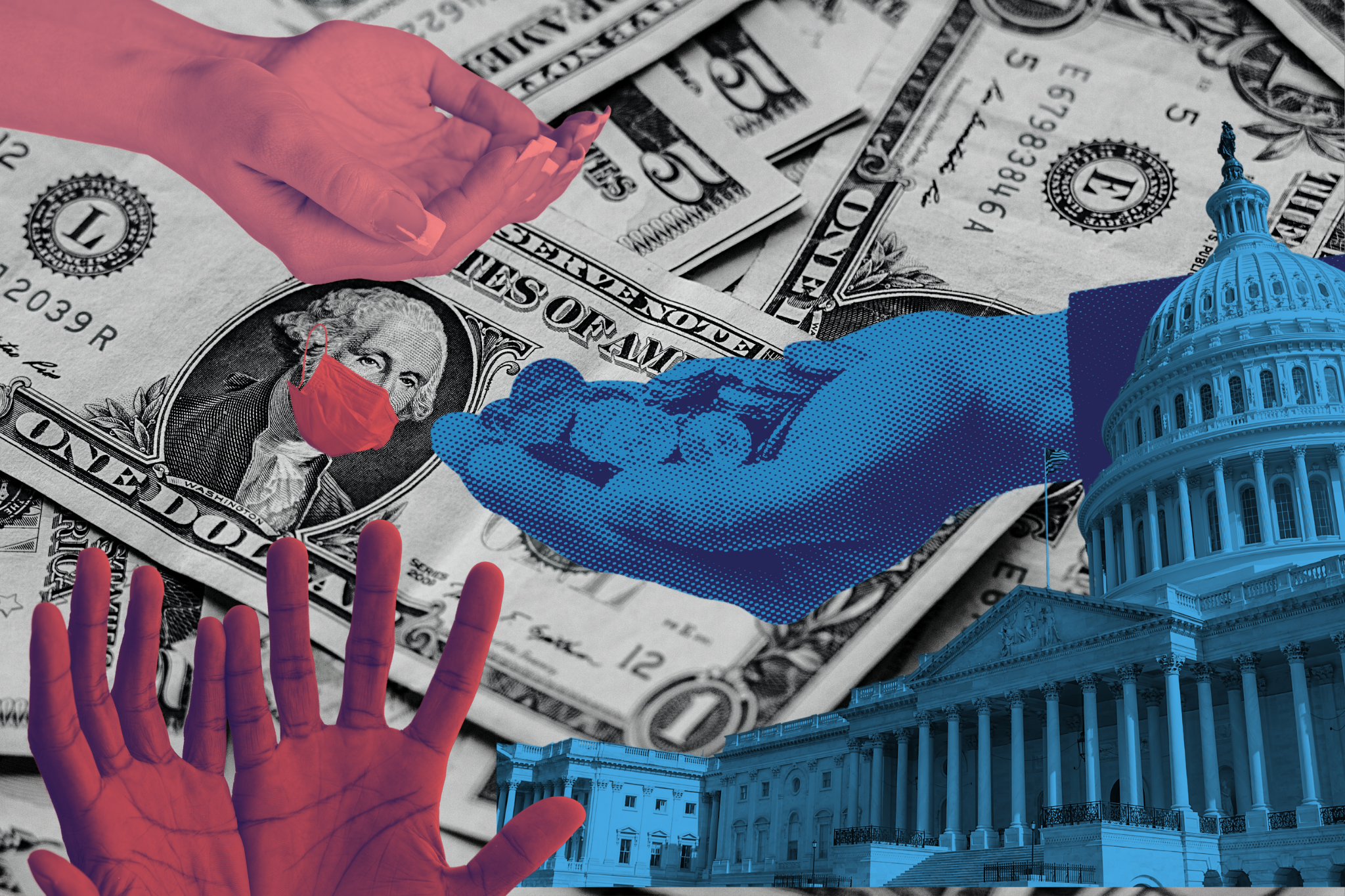

Where Did the Money Go? A Summary of Findings from CARES Act Investigations

Numerous reports from watchdogs, Congress, and news outlets have exposed serious issues with how relief funding from the 2020 CARES Act was spent. Here’s a list.

In March 2020, Congress appropriated more than $2 trillion through the CARES Act to support businesses, individuals, and government agencies as the nation began to grapple with the historic pandemic. Throughout the past year, congressional committees, watchdog groups, and news outlets have reported on how these funds have been allocated and used, often finding evidence of millions of dollars going to organizations or firms that were ineligible for funding, had engaged in misconduct, or did not use the funding as Congress intended.

Many of the findings suggested that the Trump administration, particularly the Small Business Administration (SBA) and the Treasury Department, did not carefully vet many of the companies receiving aid. In August 2020, the SBA was reportedly scrambling to enact key anti-fraud controls — even though then-Administrator Jovita Carranza claimed in July that her agency was “doing all it can to reduce the risk of fraud on the loan side.” Below is a summary of many of these reports and news investigations from recent months.

The Paycheck Protection Program (PPP) was one of the most visible pieces of the legislation. It was created to support American small businesses during the pandemic, specifically to help workers remain on the payroll. But there have been multiple reports of ineligible companies having exploited loopholes to receive millions of dollars, or of large corporations reaping benefits designed to help struggling small firms.

- ProPublica found in July 2020 that at least 15 large companies that did not qualify as small businesses collectively received more than half a billion dollars by applying for loans through smaller companies they owned.

- Research conducted by Morgan Stanley showed that more than $200 million in the initial round of PPP loans went to large publicly traded corporations. A separate report published by the Associated Press found that at least 94 publicly traded companies received PPP loans.

- Companies also double-dipped even though the CARES Act prohibited multiple loans: In September, the House Select Subcommittee on the Coronavirus Crisis found more than 10,000 cases of repeated loans.

- Funds even went to companies outside of the United States, with nine major Canadian mining corporations receiving $12 million in PPP loans, according to Accountable.US.

- In December, nine months after the PPP began, the SBA Inspector General announced that approximately $3.6 billion in PPP loans had been sent to potentially ineligible beneficiaries.

Although the main goal of the PPP was to support struggling small businesses, multiple investigations have found evidence of the program favoring wealthier companies and that wealthier businesses that were not the program’s priority group received millions in aid.

- The House Select Subcommittee on the Coronavirus Crisis released a staff report in October 2020 showing that the SBA and the Treasury encouraged big banks to provide loans to their wealthy, existing clients, often excluding minority- and women-owned businesses in the process. The investigation also revealed that several lenders processed bigger PPP loans for wealthy customers at more than twice the speed of smaller loans for the neediest small businesses.

- According to data obtained by the Washington Post, thousands of franchises of major chains received billions of dollars in PPP loans despite their affiliation with large corporations. These beneficiaries included prominent fast food chains — like Subway, Dunkin’ Donuts, and McDonald’s — hotel chains, and large auto dealerships. Other wealthy companies include weapons manufacturers that secured more than $200 million in PPP funds, despite a spike in gun sales during the pandemic, and organ transplant organizations that received loans despite having millions of dollars in financial assets.

Despite receiving millions, many CARES Act beneficiaries still laid off workers and engaged in questionable spending.

- In a December 2020 nationwide analysis, Good Jobs First found that 1,900 PPP beneficiaries laid off more than 190,000 American workers.

- A months-long investigation by the House Select Subcommittee on the Coronavirus Crisis, published in October 2020, showed that aviation contractors fired thousands of workers even as they received millions of dollars through the Payroll Support Program, which provided companies payroll assistance in exchange for keeping aviation-sector workers employed.

- The Project on Government Oversight and the Anti-Corruption Data Collective found that large political donations flowed from more than 100 PPP loan recipients, suggesting those companies might not have been struggling to prioritize paying their employees.

CARES Act funding was also granted to companies with a history of misconduct.

- Good Jobs First reported that more than 43,000 CARES Act aid recipients — including health care providers, colleges, and airlines — had engaged in a form of corporate misconduct over the past decade, and received $57 billion in grants and $91 billion in loans through the CARES Act.

- According to the House Select Committee on the Coronavirus Crisis, almost half of the 500 large companies whose bonds the Federal Reserve bought using CARES Act funding were accused of illegal conduct in the last three years.

In some cases, CARES act funding propped up companies that had been struggling since before the pandemic.

- An analysis conducted by Bailout Watch, Public Citizen, and Friends of the Earth showed that the fossil fuel industry, which was in decline before the pandemic, received more than $10 billion in economic relief. The analysis found that 37 such companies received more than $500 million in loans through the Federal Reserve, after the Fed adjusted its Main Street Lending Program to be more accessible to the fossil fuel industry.

- The Congressional Oversight Commission raised questions about the Treasury’s $700 million loan to transportation company YRC Worldwide. The loan was made through a program designed for businesses critical to national security, but the Department of Defense did not provide a satisfactory explanation for how YRC fit that description. YRC also had poor credit ratings before the pandemic, yet the Treasury provided the loan at a significantly lower interest rate than those offered to other borrowers with similar credit ratings.

Amid this misuse and fraud, minority-owned companies struggled to receive aid.

- Data analyzed by the Associated Press showed that many minority small-business owners did not receive a PPP loan until the initial program’s last weeks in July and August 2020.

- In a study released in September 2020, the Brookings Institution found that small businesses in majority-white neighborhoods received PPP loans more quickly than those in majority-Black and majority-Latino neighborhoods.

In December 2020, Congress renewed the Paycheck Protection Program. American Oversight has filed a number of Freedom of Information Act requests for more information about PPP and CARES Act relief funds, and will continue investigating the program’s effects. For more information about oversight of pandemic relief spending, visit our Oversight Tracker.