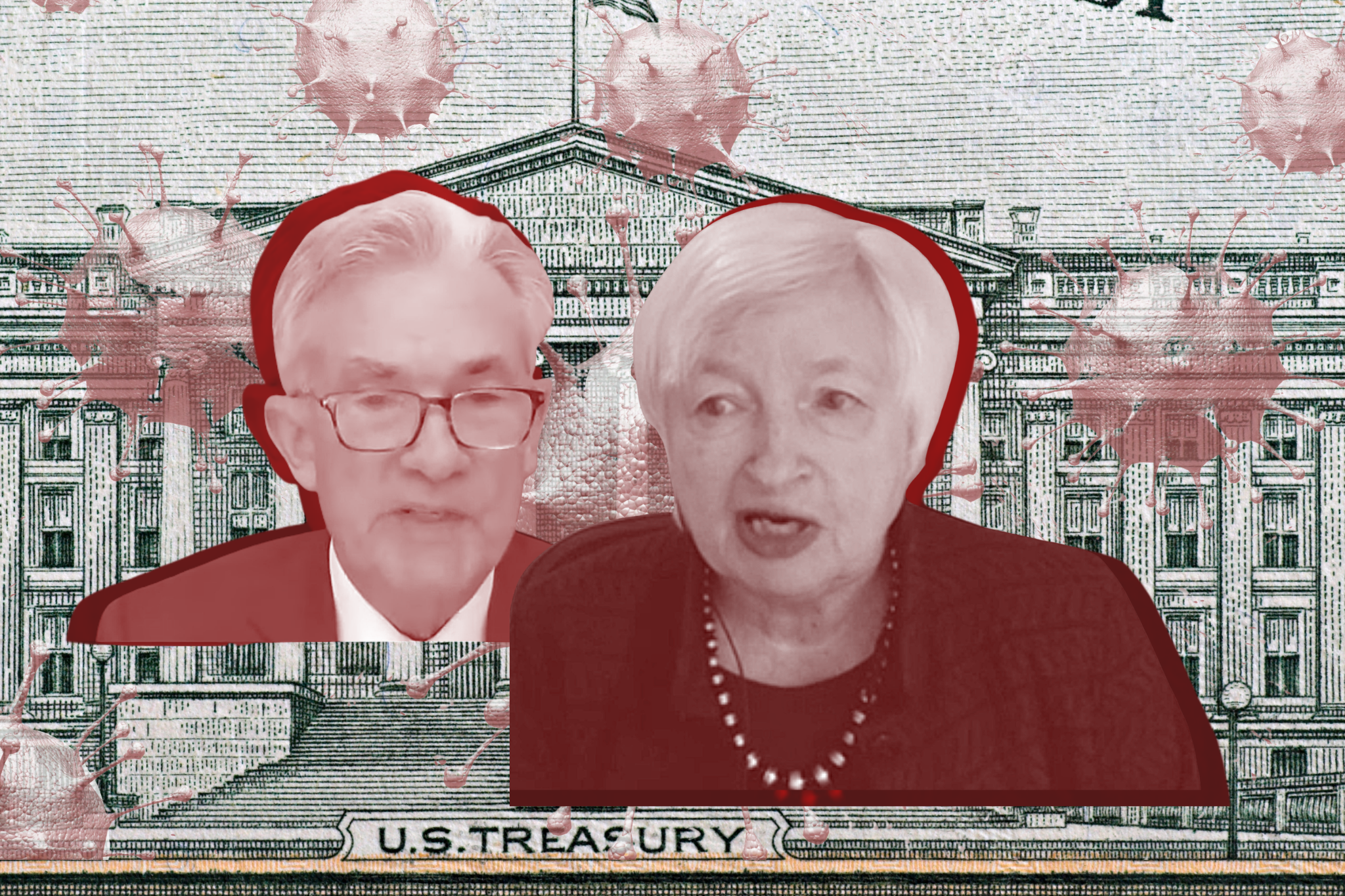

Federal Reserve Chair Jerome Powell and Treasury Secretary Janet Yellen testified in front of Congress this week, speaking to the House Financial Services Committee on Tuesday and reporting about the CARES Act to the Senate Banking Committee on Wednesday.

The hearings marked the first time Yellen, the former Fed chair, testified as Treasury secretary. In both hearings, Powell and Yellen said they expect strong economic growth this year, but emphasized that millions of Americans are still struggling due to the pandemic.

Yellen’s and Powell’s appearances on Capitol Hill came nearly two weeks after President Joe Biden signed a $1.9 trillion coronavirus stimulus bill, which included direct stimulus payments, extended unemployment insurance, and rental assistance. The package allocated $200 billion for states and cities to use, but officials in some states have demanded broader authority over this money, including the ability to use it to fund tax cuts. In her testimony on Wednesday, Yellen said her team at the Treasury Department was working on developing guidance on how the allocated funds can be used.

Yellen also said the stimulus bill, which she had publicly supported, was an “appropriate” response to the pandemic. On Tuesday, she noted the importance of provisions such as unemployment assistance, saying that the “country is still down nearly 10 million jobs from its pre-pandemic peak” and that there are still millions of people who are behind on mortgage or rent payments.

Yellen also said the Treasury is working to ensure that the Paycheck Protection Program, a 2020 CARES Act provision that provided funds to small businesses, reaches millions more businesses, “especially in rural and low-income areas.” She acknowledged that “the smallest small businesses, which are disproportionally owned by women and people of color,” were hit hard by the pandemic.

The PPP, which was extended in December, has been the subject of significant criticism following analyses that showed minority small-business owners waited for months to receive loans in the first round of PPP funding, and that small businesses in majority-white neighborhoods received loans more quickly than those in majority-Black and majority-Latino neighborhoods. The program also saw double-dipping and loans granted to large companies.

Also on Tuesday, Powell disputed criticisms that the stimulus bill would lead to increased inflation, saying, “Our best view is that the effect on inflation will be neither particularly large nor persistent.” Powell also said that the Fed “will continue to provide the economy the support that it needs for as long as it takes.”